INBRIGHT

is an independent and privately managed real estate developer, investor and asset manager.

As project developer, our strength lies in being able to recognise and tap into the individual potential of real estate. The results are tailor-made, sustainable solutions – even for complex projects and transactions. Our goal is to realise flexible and resource-conserving properties that offer a convincing price/performance ratio in the immediate vicinity.

As investment manager, we offer institutional long-term-orientated investors market access to light industrial real estate via regulated investment vehicles. We focus on stability of dividends, based on a broad diversification of risk through the multi-tenant/multi-use approach at object level.

Our focus is on light industrial and office properties in economically strong markets throughout Germany. Within the context of sale and lease back transactions, we are an uncomplicated, experienced and flexible partner. We are very familiar with the needs of medium-sized manufacturing companies. Value-based enterprise likewise connects us in this respect. Our individual ESG strategy serves in this connection as a tool for strategic corporate management. Finally, with INBRIGHT Nature, we want to make a contribution to environmental protection above and beyond that which is necessary.

OUR MOST IMPORTANT PARTNERS ARE OUR TENANTS.

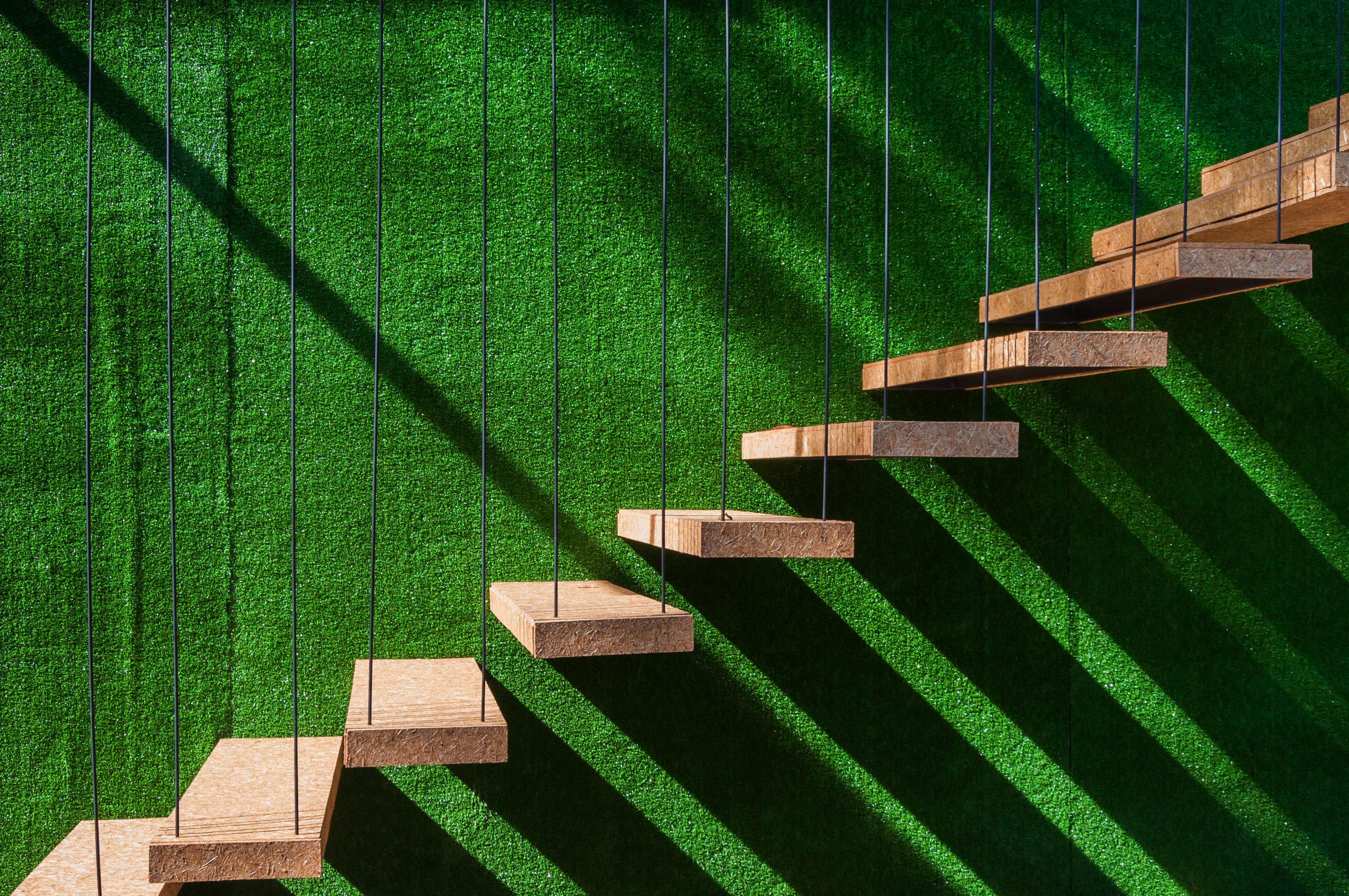

WE CREATE STABLE VALUES

We develop and manage light industrial and office properties in economically strong locations with good infrastructure and growing tenant demand. In doing so, we make sure that our properties have conceptual advantages over the competition.