light

industrial

flexible Concepts

A Light Industrial property can be identified by its central location and/or excellent transport links and its flexible use concept. In addition, as well as office space, it will almost always have a significant proportion of factory buildings or production areas with above-average room height and load bearing capacity. Another central factor is the ease of access for lorries, to ensure an adequate flow of goods.

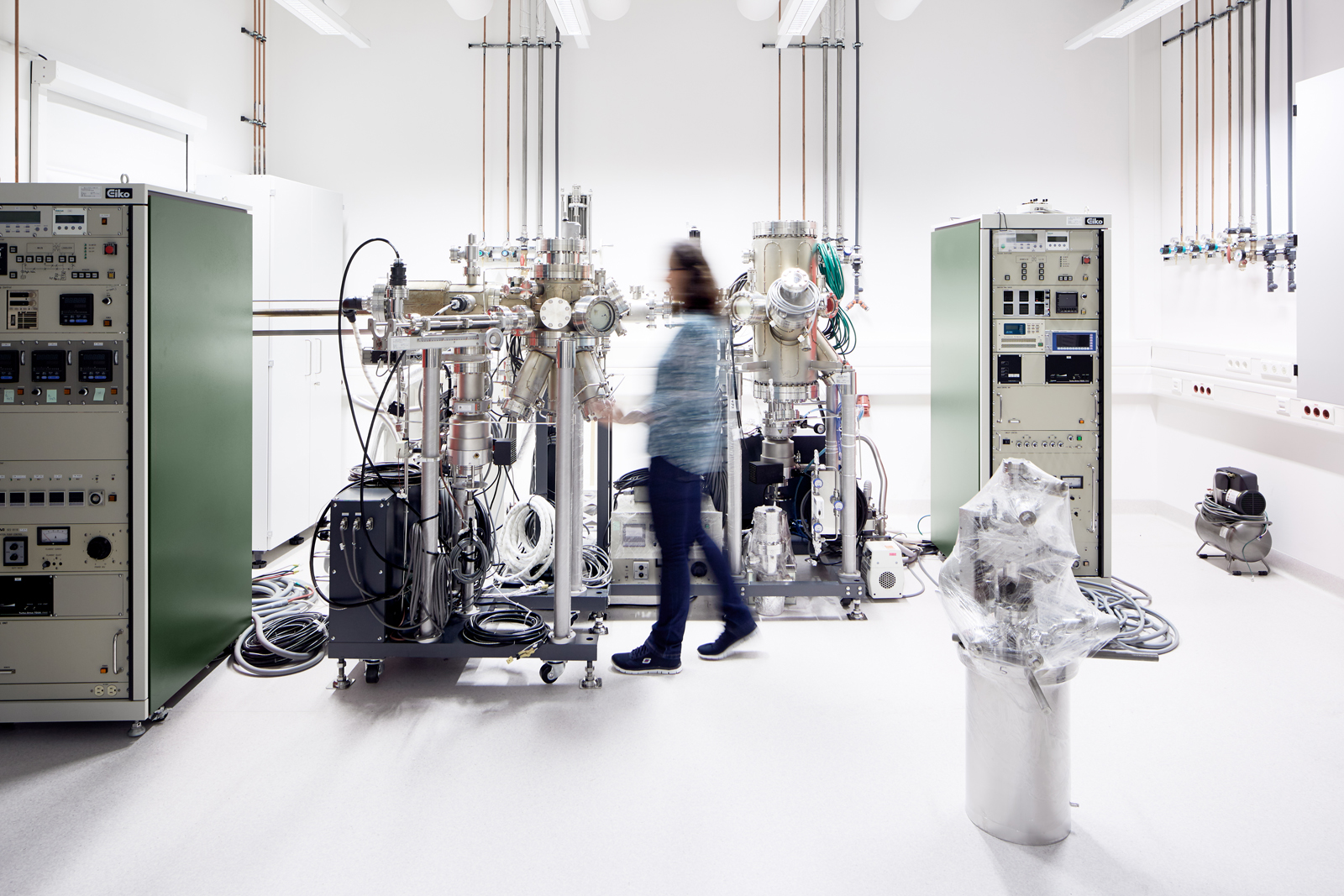

City Logistics & Production

The demand for Light Industrial properties in urban economies is increasing; the growth in online trading means that the “last mile” is gaining in relevance. The delivery of goods within just a few hours of ordering requires a logistics chain with warehousing space close to urban centres. They can be found far more in the inner cities and industrial areas close to the centre – as a component of multi-use concepts, summarised under the term “light industrial”.

As well as warehouse space, these properties also offer space for low-emission production, such as additive manufacturing. The decisive factor is that light industrial properties can be used flexibly and rearranged. They are therefore different to traditional logistics and industrial properties, which were designed for a specific use or an individual company.

Development of existing properties

A major advantage of the existing light industrial properties is their location. As a result of the expansion of towns and cities over the last few decades, many industrial areas which were once located on the edges of the conurbations, were gradually integrated into the urban developments. Across the world, former industrial complexes dating back to the industrial revolution are now to be found in the middle of urban town centre locations. The associated connections to public transport and proximity to the homes of employees are two important advantages resulting from this. Industrial properties with office or warehouse space and potential for conversion in such urban locations are premium properties for light industrial specialists.

Experienced players on the market such as INBRIGHT can deal with the special challenges of existing properties such as the complex framework conditions regarding planning and implementation as well as how to handle any potential harmful substances and contaminated soils. Where this is a possibility, new build potential is also achieved, in addition to the extensive redevelopment of the existing properties.

Investors are on the look-out For light industrial properties

The light industrial asset class is becoming increasingly popular with institutional investors owing to the attractive risk-profit ratio. The flexibility of property use and a normally high granularity of rental income ensures a wider distribution of risk than that possible in other property asset classes.

One challenge for Light Industrial project developers is balancing cost efficiency on the one hand and compliance with ESG criteria on the other hand. You can find out more about how INBRIGHT manages ESG here.