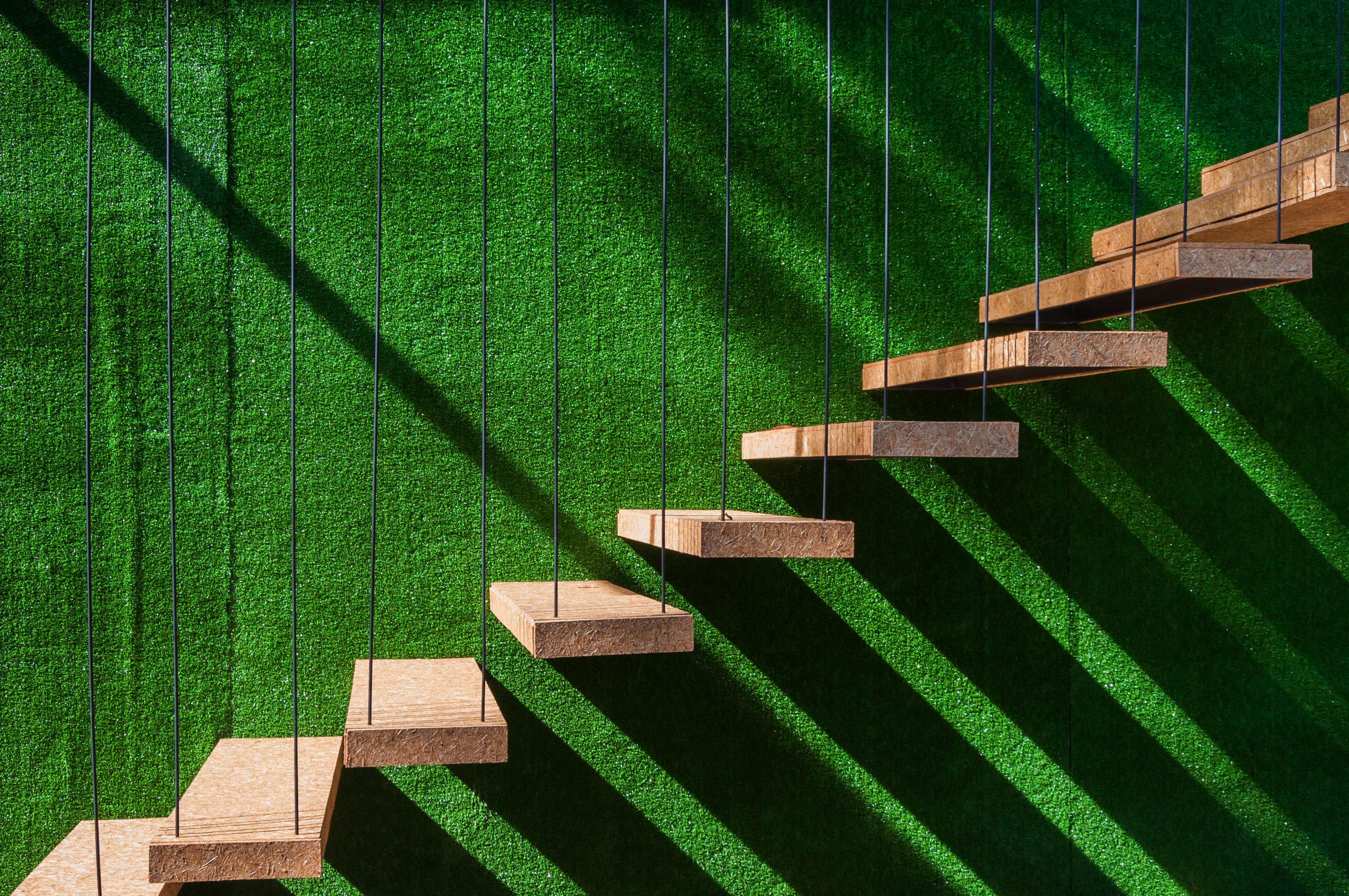

Sale and

lease back

Selling Company-owned real estate

A company selling its own properties and renting them back – that is the core concept of “sale and lease back”. The advantages are obvious: The company generates liquidity from the property sale which it then can invest in its actual core business. Corporate value rises. In addition, there are no longer costs for maintaining the property: that is now up to the new owner. The selling company gains in flexibility: individual parts of the enterprise can be relocated or outsourced, space is rented as and when needed. Selling company-owned real estate is thus a component of structural change and making the company future-proof.

Level playing field between tenants and landlord

One of the most important preconditions for sale and lease back transactions succeeding is a level playing field. INBRIGHT as buyer and future landlord plans long-term together with the selling company. The future plans and wishes of the seller are incorporated into the drafting of the contract so that protection and participation are guaranteed. The motto is “built to suit”: INBRIGHT builds and modernises buildings to suit the needs of their tenants.

Alternative-use functionality through multi-tenant solution

As the new owner and investor, INBRIGHT can modernise vacant space and place it in the property market. The objective is to inject alternative-use functionality into the previously single-use business premises. Thus, sale and lease back is also a contribution to the economic revitalisation of what was a single-tenant property. As a multi-tenant solution, the business property is more secure for investors, because the loss of one tenant will not impact the whole real estate investment.

Non-binding and discreet information

You are contemplating whether or not to sell a company-owned property and then lease some or all of it back? Then contact INBRIGHT without any further obligation. We assure you of the highest discretion. Please also take a look at our acquisition profile.

Contact

Steffen Uttich

partner

INBRIGHT Development GmbH

Erasmusstraße 14

10553 Berlin

Mobile: +49 30 403 686 2-0

Email: sfu@inbright.de